Wondering About Financing Your Restaurant Franchise?

For our franchise development team here at the Burrito Shak, it happens just about every day. We are asked the same series of questions by phone or email or face-to-face, but they are always the most obvious questions we can answer. If you are thinking about investing in any franchise opportunity, these are usually a few questions that come to mind first:

- How much money will I make?

- How many people will I need to hire?

- How can I finance this franchise investment?

The U.S. Small Business Administration (SBA) has your answers!

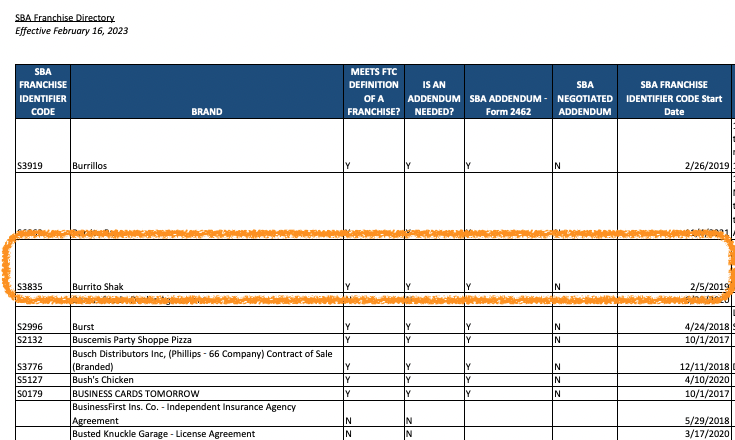

While some questions we legally can’t answer directly, like how much you’ll make, we can help with the others. Actually, because the Burrito Shak team has worked with the SBA for four years now, they have captured most of our answers already and they make them available publicly. Many questions about the legitimacy of any franchise opportunities can be answered simply by checking the SBA’s Franchise Directory (previously known as The Registry).

What is the Small Business Administration’s Franchise Directory?

This online tool will be very powerful in helping bankers or lenders secure funding for your restaurant business. The SBA’s Franchise Directory gives these financial professionals a quick way to validate all eligible franchise brand and better understand any special requirements with lending to people starting a franchise business. Because the SBA acts as a guarantor on SBA Loans for new businesses, getting financing to open your own Burrito Shak restaurant is not only is easier than borrowing funds to start your own independent restaurant, but odds are good the approval process will be quicker and interest rates will be lower as well.

Our SBA Loan approval process was streamlined due to our lending partner’s quick ability to have comfort with the Burrito Shak and the investment from their partnership within the SBA Directory.

— Noah – Burrito Shak Franchisee in Cary, NC

The SBA’s Franchise Directory is a 200+ page PDF you can download for free that alphabetically lists more than 2,000 different franchise opportunities. The directory is updated every few weeks, so keep that in mind when speaking with local lenders. Each brand that’s approved within the directory includes some simple details related to the SBA, including when the SBA assigned that franchisor an identifier code. For the Burrito Shak, we qualified with the SBA back in 2019!

Because our Burrito Shak team continues to maintain our SBA Franchise Directory listing and because our franchisees continue to repay their business loans, future franchisees will likely find success with leveraging SBA Loans to open their own restaurants. To learn more about becoming a Burrito Shak restaurant owner, request our 2023 Information Kit today!